Introduction

Managing a 1,000-person SaaS company is like steering a cruise ship. Every course correction takes months. Every department has its own momentum. And legacy operations eat margin.

I learned this firsthand while leading Product-Led Growth. I inherited a sales-first motion (high CAC, low margin) and spent 18 months rebuilding the SMB funnel around self-serve and hand-raiser qualification. We cut customer acquisition cost by 70%, reduced deal cycles from 20 hours to 2 hours per deal, and increased deal value 30% through hybrid pricing.

Below is how I would execute that playbook to a $300M SaaS company facing the same wall.

Here's a scenario: A 30-year-old, Private Equity-backed SaaS company generates ~$300M in ARR with 40,000+ customers. They excel at Mid-Market and have built a traditional Sales-Led GTM, and it's been profitable.

But in 2026, that model is hitting a wall:

200 sales reps are spending 30% of their time on $3K-$5K SMB deals

A single SMB customer costs $7K to acquire (vs. generating only $3K-$5K in year-one revenue)

The SMB segment ($50M ARR) operates at 20% margin, while Enterprise operates at 80%+

Your RevOps team is drowning in 2,000+ low-value SMB leads instead of supporting 50 high-value Enterprise deals

The reality is the playbook that got them to $300M, high-touch closing, consultative selling, heavy sales teams, won't get them to $500M. Not without fundamental operational transformation.

To maximize profit and unlock the next phase of growth, they need to shift the organization:

Move SMB to automated self-serve by automating acquisition, onboarding, and expansion for deals <$10K.

Retrain mid-market/SMB reps to hunt $100K+ enterprise deals

Experiment with hybrid pricing (seat-based + usage-based) to increase ARPU revenue

This is a playbook (18-24 months) for transformation. The levers I will talk about below:

Sales Organization Upgrade (Move SMB/MidMarket reps → Enterprise)

Operational Efficiency (Automate SMB sales via self-serve/PLG)

Pricing & Packaging (Hybrid per-seat + usage-based to maximize ARPU)

Sales Enablement/Training (Train reps to sell enterprise value, not just features)

Retention/NRR (Expansion revenue from existing base without new sales cost)

Cost Structure Optimization (self-serve support, automated onboarding, human consultative service setup becomes an add-on)

Table of Contents

Why self-serve matters now for a $300M SaaS?

How have SMB buyer expectations changed in 2026?

Customers now expect free trials, self-serve onboarding, and transparent pricing. The 90-day sales cycle for a $3K deal no longer makes financial sense.

Modern SMB buyers compare you against Calendly (freemium), When I Work (instant signup), and Gusto (clear pricing). If your SMB motion requires a sales rep breathing down the prospect’s neck to buy, you already lost on efficiency.

Why is PE pressuring for margin expansion now?

Private equity owners evaluate SaaS companies using the Rule of 40: growth rate + profit margin should be ≥ 40%. Primarily product-led companies exceed the Rule of 40 and Rule of 50 at a higher rate and is the benchmark for efficient growth.

A $50M SMB segment operating at 27% margin (after factoring in churn replenishment and hidden costs) is actively dragging down that score. Moving SMB to self-serve can lift the margin side by 20-30 points without sacrificing growth—directly translating to higher exit multiples.

For a PE-backed company, this isn't optional. It's the path to a successful exit.

What competitive threats are legacy SaaS companies facing?

Newer entrants are natively PLG. Legacy players still using pure Sales-Led are losing mid-market customers to friction-free alternatives. Enterprise is also shifting: CIOs now expect to "try before you buy," and more capabilities and integrations across platforms. Making sure those workflows are plugged-in and working matches technological capabilities.

For more on how product-led growth impacts margin and valuation, see my deep dive on Product-Led Growth vs Sales-Led Growth.

Why is paying $70K+ reps to close $3K deals unsustainable?

Paying $70K+ for reps to handle $3K deals is increasingly unsustainable. SMB deals might not needed sales rep to close. Re-deploying that talent to enterprise sales will pay off in the long run.

The Tension: Why 30-year-old SaaS companies delay the self-serve shift?

Most mature SaaS companies know this transformation is necessary but resist it. Sales compensation threatens, and reps see it as a pay cut. Engineers resist because a self-serve experience disrupts their existing architecture. Finance will see this change as a near-term margin dip with inconclusive returns. It takes 18-24 months while running two GTMs.

The companies that win are those who accept the 18-month pain to unlock 5+ years of margin expansion.

It's also a cultural shift. These companies have hundreds of people who've seen success, but may not understand the financial operating breakdown.

It really comes from a strategic mandate from the top down. From leadership down.

Problem: What is the sales efficiency trap in the SMB segment?

A company like this has built a sales organization designed for complexity: territory management, deal desks, solution engineering, and high-touch closing. This infrastructure is purpose-built for closing $100K+ Enterprise contracts.

But right now, that same heavy infrastructure is being used to close $3K SMB deals.

Why is sales efficiency upside down?

Deal Type | Deal Size | Sales Cycle | Sales Cost | Efficiency Ratio | Status |

|---|---|---|---|---|---|

Enterprise | $100K | 160 days | $15K | 6.7:1 ✅ | Efficient |

Mid-Market | $20K | 120 days | $8K | 2.5:1 ⚠️ | Healthy, Room for Growth |

SMB | $3K | 90 days | $7K | 0.43:1 ❌ | Inefficient (Broken Model) |

With this assumption, the Enterprise sales generate $6.70 in revenue for every $1 spent. SMB generates only $0.43 for every $1 spent. This is the core problem.

The same sales operations infrastructure (pipeline forecasting, deal approvals, manual outreach) that works brilliantly for Enterprise customers becomes a profitability killer for SMB customers.

A company excels at Mid-Market. They have spent the last 25+ years building a robust sales org of expert hunters and consultative sellers. But applying that Sales-Led machine to $3K SMB deals creates massive operational drag.

Problem #1: Best Sales reps are wasting time on small deals

Your sales team is:

Spending 30% of time on SMB deals (low ACV, high touch)

Missing Enterprise opportunities while chasing small accounts

Adding zero value, most SMB deals would have closed via self-serve without a rep

RevOps Overhead: Drowning in volume, managing 2,000+ low-value SMB leads instead of supporting 50 high-value Enterprise deals.

Pipeline Forecasting: Cluttered with thousands of "maybe" SMB deals

CRM Hygiene: Enterprise data gets buried in the noise of high-volume SMB churn

Enablement: Training resources are split between "How to demo basics" (SMB) and "How to sell value" (Enterprise)

Problem #2: SMB profits are only ~27% (Enterprise is ~80%)

On paper, the SMB segment generates $50M in ARR. It looks like "icing on the cake."

In reality, the Enterprise and Mid-Market contracts are subsidizing a massive, inefficient SMB operation.

The Economics of Inefficiency:

Let's look at the estimated costs for the SMB sales motion:

200 Sales Reps @ $70K (fully loaded) = $14M Direct Cost

25 Sales Managers @ $160K (fully loaded) = $4M Management Tax

SMB ARR Generated: ~$50M

The Hidden "Cost of Complexity" (Estimated ~27% of Revenue):

It's not just salaries. It's the infrastructure required to prop up high-volume, low-ACV sales:

Sales Engineering: Highly paid technical resources pulled into $3K demos

Implementation: "White glove" onboarding costs for customers who should be self-serve

Support Volume: SMBs generate 3x more tickets per dollar of revenue than Enterprise

Churn Replenishment: With SMB churn at ~15-20%, sales must close $10M/year just to stay flat

Cost Category | Annual Cost | % of SMB ~$50M ARR |

|---|---|---|

Direct Sales Labor (200 Reps + 25 Managers) | $18.0M | 36% |

Sales Ops & Enablement (Tooling, RevOps, Enablement) | $3.2M | 6% |

Service & Onboarding (Support, Implementation) | $5.0M | 10% |

Churn Replenishment (Marketing/CAC to replace 15% churn) | $10.5M | 21% |

TOTAL COST TO SERVICE SMB | $36.7M | 73% |

As a result, the SMB segment is operating at a ~27% margin, while Enterprise operates at 80%+. For a PE-backed SaaS company, this margin drag compresses valuation and kills efficiency.

Productizing the self-serve motion alleviates the sales team. That's why the product team needs to own the revenue and the P&L of the self-serve strategy.

The Solution: How do you fix SMB margin without killing growth?

Stop trying to force a high-touch sales team to be efficient at low-value SMB deals. It's a losing math problem.

By shifting SMB to a low-touch, automated self-serve motion, a company achieves three strategic wins instantly:

Immediate Margin Expansion: You stop spending expensive sales hours on low-value deals. A $3K deal becomes pure margin when acquired via self-serve vs. a loss when touched by a rep.

Mid-Market Stability: Refocus your "SMB" reps on Mid-Market accounts ($20K+ ACV). These deals justify the effort, churn less, and build a healthier pipeline.

Enterprise Focus: Unleash your top talent to hunt, train for, and close the $100K+ deals that actually move the needle.

The hybrid approach (combining self-serve with sales assistance for high-intent customers) is detailed in my guide to Product-Led Sales 2025, where I break down the sales assist model and how it differs from pure PLG.

What does the new SMB playbook look like with self-serve?

Old Way (Inefficient):

SMB Customer → Mid-Market Sales Rep → 90 Days of Friction → $3K Revenue ❌

(90 Days includes: Manual prospecting, persistent follow-ups, scheduling demos, looping in Sales Engineering, chasing contracts, and Ops approval... all for a $3K outcome.)

New Way (Efficient):

SMB Customer → Self-Serve Funnel → Hand-Raiser Signal → Sales Assist → 14 Days → $3K Revenue ✅

(14 Days includes: Customer self-qualifies via usage, Rep gets alerted to "hot" lead, Rep closes specific need/upsell. Zero prospecting. Zero wasted demos.)

There are certain deals that a sales rep can keep pursuing and push to close. However, there are also deals where the prospect is just curious or indecisive, or they would close on their own.

Automating the detection and qualification of these deals helps shift the sales rep's time toward accounts that are more highly qualified.

How does self-serve change sales team efficiency?

By shifting to this model, we aren't just "saving time." We are fundamentally changing the unit economics of the sales floor.

Metric | Old Way (Sales-Led) | New Way (Product-Led) | Impact |

|---|---|---|---|

Deal Size | $3,000 | $4,000 | +33% |

Time Spent by Rep | 20 Hours | 2 Hours | -90% |

Activity | Cold calls, multiple demos, chasing | Closing qualified hand-raisers | High Value |

Revenue per Hour | $150/hr | $2,000/hr | 13x Efficiency |

That is a 13x improvement in Sales ROI.

But where does the $4K come from? It comes from Hybrid Pricing (Step 3 in our playbook). Instead of a flat $3K deal, a self-serve customer pays:

$3K Base (Same as before)

+$500-$1,000 Usage-Based Add-ons (Geofencing, API, Integrations they actually use)

Result: $3K → $4K deal (30% uplift).

Additionally, hand-raisers are higher-intent customers (they've already proven product-value), so they convert faster (2 hours vs. 20 hours), adopt more features (driving more add-on revenue), and churn less (due to self-selection into product).

See Step 3 (Hybrid Pricing) and Step 2 (Automated Hand-Raiser System) below for how this actually works.

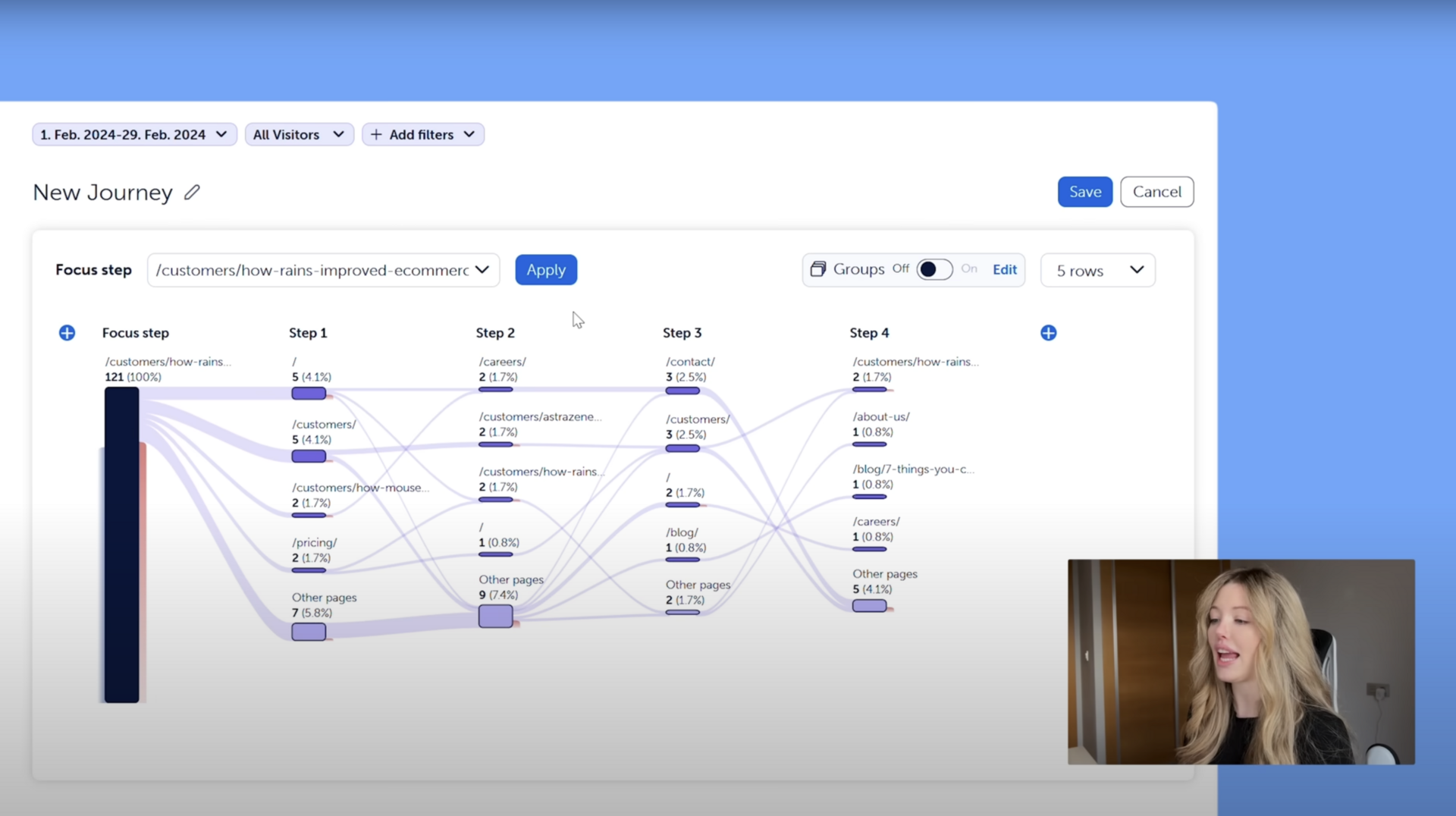

How to execute self-serve automation and build predictable SMB revenue?

Build a Hand-Raiser System: Detect high-intent signals in-app (e.g., hitting paywalls, adding users) to identify who needs sales help

Automate Workflows: Replace manual follow-up with automated notifications, battle cards, and sequences

Tooling Shift: Use tools like Groove or Zendesk to manage high-volume SMB inbound, keeping the CRM clean for Enterprise

Evolve Sales Ops: Move from "manual deal coordination" to "automated intelligence"

THE PAYOFF

Enterprise Focus: Sales team chases fewer, higher-margin deals ($50K+)

Operational Efficiency: SMB becomes a self-sustaining revenue engine with minimal headcount

Cost Reduction: Sales Ops costs drop from ~6% of revenue to ~2% via automation

Bottom Line: Company margins improve significantly, directly impacting Valuation

What is the product-led-sales (PLS) self-serve playbook?

Step 1: How do you define 'high-intent' customers with engagement milestones?

Objective: Define engagement milestones (before alerts)

Goal: Scientifically define "High Intent" so Sales only touches winners.

We don't guess. We track. Here are the 4 signals that predict conversion:

Activation: Created 10+ schedules in the last 7 days. (They are using the core product)

Adoption: Invited >50% of their estimated workforce. (The team is committed)

Stickiness: Downloaded the mobile app. (They are managing on-the-go)

Customization: Setup custom branding/roles. (They have "moved in")

The Scoring Model:

Each milestone = Points.

< 20 Points: Nurture (Automated emails)

50 Points: Hand-Raiser (Ready for Sales)

Once you mapped your milestones, start by creating a product-led bumper system. This would drive your customers to hand raise.

Step 2: How does a smart automated hand-raiser system work?

Objective: Automated hand raiser system

Goal: Build a trusted pipeline between Product and Sales.

The Problem Today:

Alerts are noisy. Sales ignores them. RevOps manually scrubs data. Trust is low.

The Solution: The "Hand-Raiser Squad"

Form a small, fast team (1 PM, 1 Engineer, 1 RevOps, 1 Sales Rep, 1 Customer Success rep). Their job is to refine the signal until Sales trusts it implicitly.

Operational Workflow:

Signal: Customer hits 50 points (e.g., Hits paywall + Invited 10 users)

Enrichment: System checks firmographics (Is this a real company? >20 employees?)

Alert: Slack/CRM notification sent to Sales Assist Rep

Context: "Acme Corp just hit the schedule limit. High Intent."

Action: Rep uses a pre-built Battle Card (e.g., "Paywall Hit Script") to reach out

Human-in-the-Loop:

Automation tees it up; Humans knock it down. The Rep reviews the alert, confirms context, and launches the sequence.

Building this cross-functional squad and measuring its effectiveness requires deep product-sales alignment. See my article on PLG + Customer Success for how to structure this relationship.

Step 3: How does hybrid pricing increase ACV without scaring customers?

Objective: Hybrid pricing (per-seat + usage)

Goal: Stop leaving money on the table. Move from flat fees to value-based monetization.

The Shift:

Currently, companies likely use simple per-seat pricing (e.g., $50/user). This caps revenue.

We move to a Hybrid Model: Per-Seat Base + Usage-Based Add-ons.

How it works (The Squeeze):

Base: Keep the per-seat pricing (familiarity)

Add-on: Feature-gate high-value utilities (API access, Geofencing, Payroll Export)

Usage: Charge for volume overages (e.g., Schedules created, SMS alerts sent)

Example: Instead of a flat $500/mo, a heavy user pays $500 (Base) + $200 (Geofencing) + $100 (Schedule Overages) = $800/mo.

Result: ARPU increases without raising the base price.

Execution (Wizard of Oz Experiment):

Don't build billing infrastructure yet.

Weeks 1-4: Manually email 50 heavy users hitting limits. Offer them a "Power User" add-on for a flat fee

Measure: Willingness to pay

Build: Only automate once you've proven the model

For the detailed mechanics of hybrid pricing (including how to test willingness-to-pay and avoid pitfalls) see my complete guide: Advanced Pricing & Packaging Strategies in a PLG Motion and Usage-based Pricing

Step 4: How do you eliminate sticker shock at the paywall?

Objective: Set expectations on pricing.

Goal: Eliminate "Sticker Shock" at the paywall.

Don't hide pricing. Educate early.

Day 1 (Welcome): "Your plan includes 100 schedules. Power users can add more for just $2/schedule."

Day 3 (In-App): "You're at 80% of your schedule limit. Upgrade to Teams for unlimited?"

Day 7 (Value Recap): "You saved 10 hours scheduling this week. Imagine what the API integration could do."

Result: When they hit the paywall, the upgrade feels like a natural step, not a penalty.

Start education and expectation early, I wrote about in the Product-Led Onboarding Call. And read more about Product Led Paywalls on how to design proper paywalls and increase upsells.

Step 5: How do you 3x ACV with upsell and expansion?

Objective: Increase expansion and upsells

Goal: Turn $3K customers into $10K customers.

Once the engine is running, deploy specific plays for existing customers:

The "Compliance" Play: Upsell Healthcare/Gov customers on audit logs ($500/mo)

The "Integration" Play: Upsell technical teams on API access ($300/mo)

The "Enterprise" Play: Identify SMBs growing fast and route to Enterprise sales before they churn

Now that you set up expectations and education, and product-led bumpers to get more handraisers, optimize your paywall strategy for expansion sales.

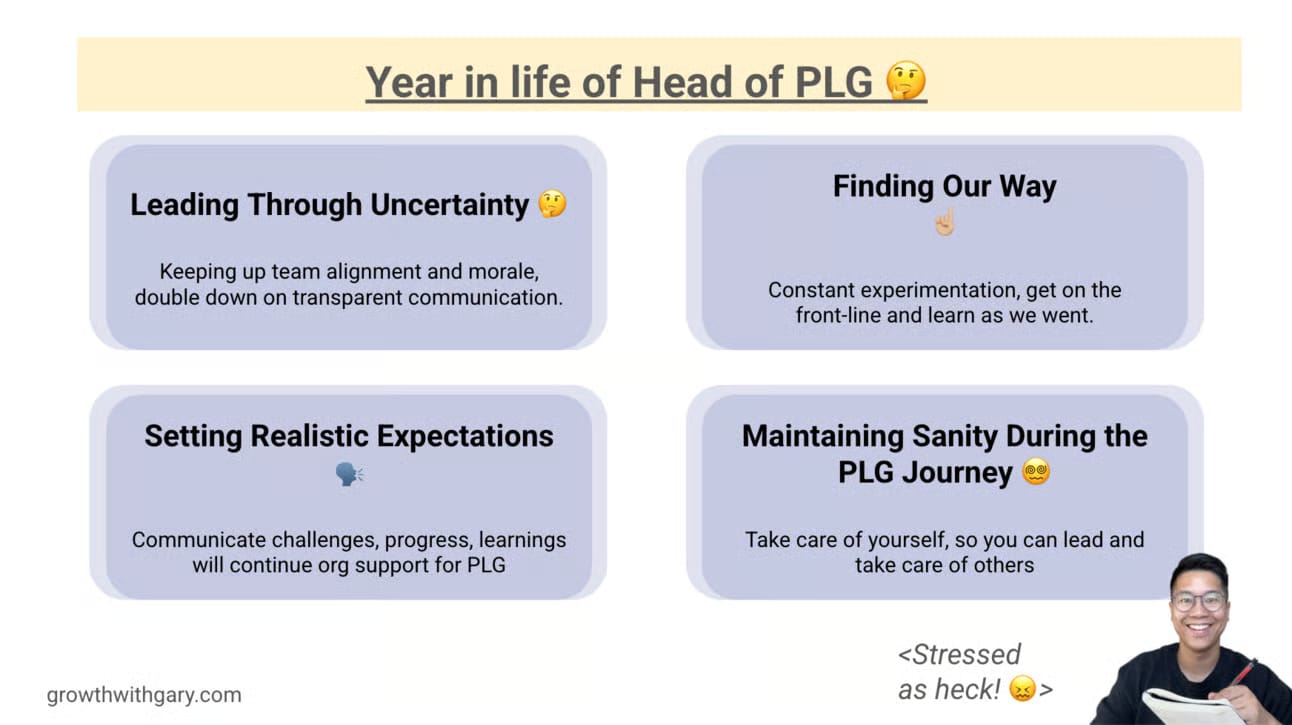

What makes implementing Self-Serve so difficult?

This playbook sounds clean on paper. Here's what actually breaks it:

Challenge #1: Sales Team Resistance

Your best SMB reps will fight this. They see hand-raisers as "lower effort" and worry about comp impact. Solution: Transparent communication from leadership + structured comp redesign (don't cut pay, restructure bonuses around expansion deals). This takes 6-9 months to stabilize.

It needs to be a mandate from the top down. I have seen that it's not the sales reps who have a challenge; it's the sales managers who want to keep the old ways.

I have seen how the “old guards” wants to maintain the status quo, and it needs to be communicated very clearly to them that the self-serve motion requires a different operation. They need to adapt, not slowly but quickly.

Challenge #2: Product Simplification

Your product was built for complexity (consulting teams loved customization). Self-serve demands simplification (defaults matter more than options). Your engineers will resist. Your design team will debate "quick wins" that aren't. Plan 4-6 months of tough prioritization conversations.

What have work histroically in my experience, it needs to be done very quickly in a protected PLG growth pod. We're bringing in engineers to quickly optimize the onboarding, paywalls, and self-serve elements, so it can be showcased without the drag of red tape and the old engineering culture.

Challenge #3: Running Two GTMs Simultaneously

For 12-18 months, you have Sales-Led AND Product-Led operating at the same time. RevOps becomes a nightmare (two pipelines, two forecasts, two comp plans). You need a dedicated Project Management team (~2 FTEs) to run interference. Budget $400K+ for this overhead.

What I experience and observe, at first, the Salesforce, Revop section, and the SKU will be messy. The teams are not going to get used to it, and it won't make sense until it starts to generate revenue and deals are closing via self-serve and qualified leads.

Once that happens, all the other teams—the finance team, the sales team, and the ops team, will play ball and incorporate this into their Salesforce reporting.

Challenge #4: Churn During Transition

Some SMB customers will hate the self-serve model and churn. You'll lose customers to competitors who offer "white glove" service. Plan for 5-10% SMB churn during Year 1 (vs. your normal 15-20%).

Challenge #5: Board/Investor Questions

PE investors track revenue and margin obsessively. When revenue is flat (Year 1) but you're investing in new systems, they'll question your execution. You need a clear narrative: "We're trading Year 1 margin investment for Year 2-3 structural profit expansion." Have the numbers ready.

The narrative that has worked is how systematic this product-led operation has become. It's predictable, it's fluid, and it's working.

Once that's clear, it's very easy for any external stakeholder to get excited.

The Trade-off You're Making:

18 months of operational chaos and flat revenue for 5+ years of 70%+ margin and predictable growth. The companies that win are those who accept the pain upfront and don't blink when the board questions it.

How to map the financial forecast (P&L) for Product-Led Growth?

What changes in the P&L from Year 0 to Year 2?

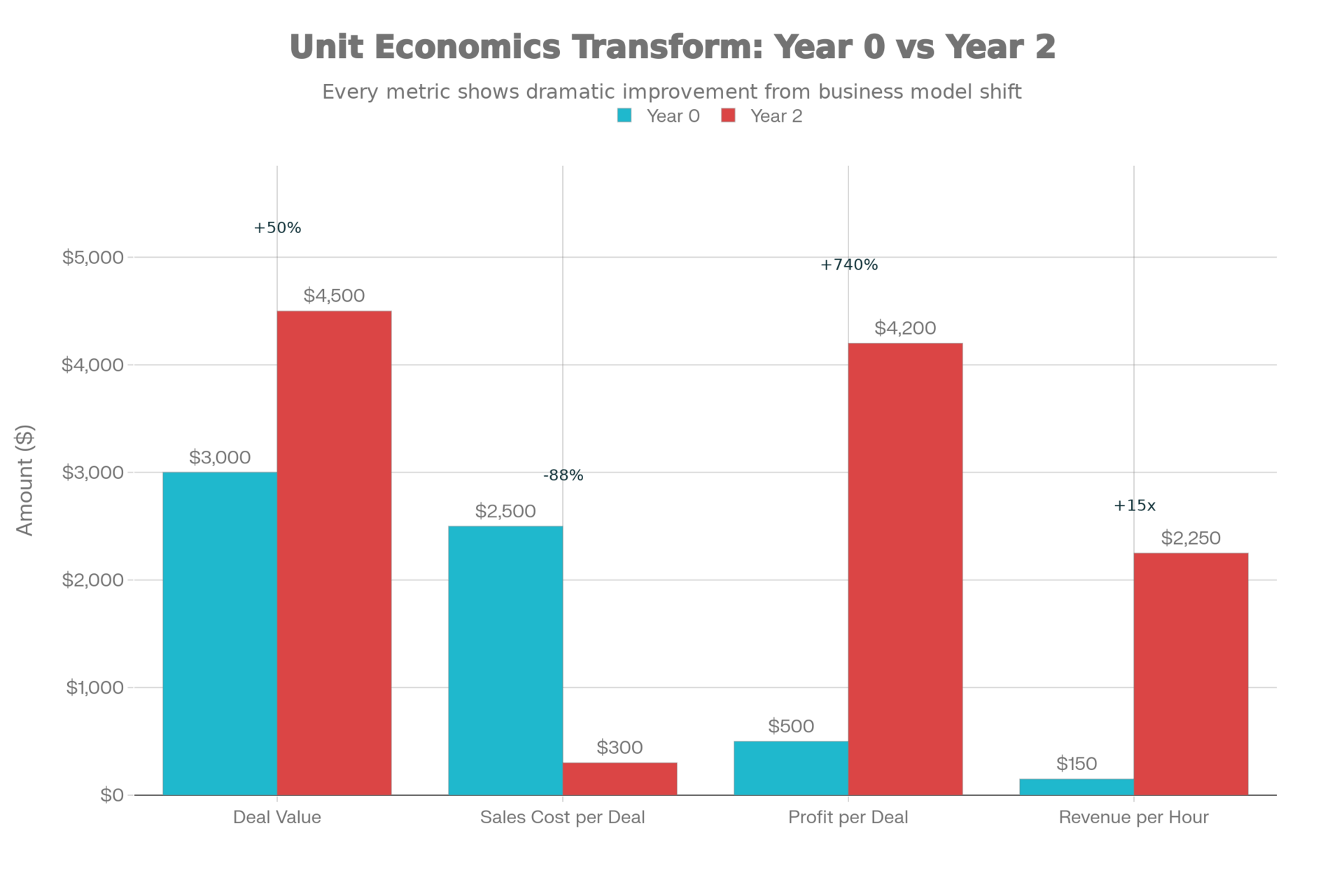

Your deal value increases 50% (customers paying for more value). Your cost to acquire decreases 88% (self-serve is cheap). Your profit per deal increases 740%. Your reps become 15x more productive.

Metric | Year 0 | Year 2 | Change | Driver |

|---|---|---|---|---|

Deal Value | $3,000 | $4,500 | +50% | |

Sales Cost per Deal | $2,500 | $300 | -88% | |

Profit per Deal | $500 | $4,200 | +740% | Combined effect of higher deal value + lower sales cost |

Revenue per Sales Hour | $150/hr | $2,250/hr | +15x | |

Sales Cost % of Revenue | 36% | 3.3% | -32.7 pts | Operational leverage from product-led motion |

Year 0: Today (Baseline)

Your SMB segment generates $50M in ARR but operates at only 27% margin. Why? 200 sales reps are closing $3K deals while Enterprise operates at 80%+ margin. You're spending $0.73 to acquire and serve every $1 of SMB revenue, which is fundamentally broken unit economics. The infrastructure that works for $100K enterprise deals is killing SMB profitability.

Year 1: Transition (Building New Systems)

Running two systems simultaneously: old Sales-Led + new Product-Led. This is expensive. It's also necessary.

What Changes:

Pricing (Step 3): Move from flat $3K deals to hybrid model ($3K base + usage add-ons). Deal value increases to $3.5K average (+17%)

Sales Motion (Step 2): Build in-product hand-raiser system that surfaces high-intent customers to Sales Assist team (10 reps). No more prospecting. Sales cost per deal drops 50%

Product Onboarding (Step 4): Educate customers on pricing at signup. Upgrade conversion climbs from 11% → 25%

The Result: Revenue stays flat at $50M (intentional, we are shifting mix, not chasing growth). OPEX drops 45% (self-serve acquisition is free, support volume shrinks). Profit grows 49% despite flat revenue. This proves margin expansion works.

Year 2: Optimized (Systems Humming)

Self-serve is default. Hybrid pricing fully implemented. Expansion revenue is automatic. Cost structure lean.

What Delivers Growth:

Usage-Based Expansion (Step 5): Existing customers pay more as they scale. This generates +$4M ARR from your current base (zero sales cost). NRR >120%

Vertical Add-Ons: Upsell compliance, API, integrations ($300-$500/mo). +$1M ARR

Self-Serve Efficiency: 80% of new SMB acquisition is self-serve; 20% routes through Sales Assist. Acquisition costs plummet, margins skyrocket

The Result: Revenue grows to $60M (+20%) from expansion + new self-serve customers. OPEX drops to $9M (15% of revenue). Profit nearly doubles to $51M (85% margin).

Three product-led strategies need to be executed and optimized

Hybrid Pricing Works → Customers accept usage-based add-ons. Risk: Low. Proven across thousands of SaaS companies

Hand-Raiser System Is Accurate → Product signals reliably predict sales-ready customers. Risk: Medium. Requires 6 months of iteration; expect noisy signals early.

Self-Serve Scales → Customers onboard and adopt without sales help. Risk: Medium-High. Demands product simplification; your current design won't support this without work.

If all three work, $27M profit improvement. If you hit 2 out of 3: $15M+ in profit. Either way, you're trading $6M in Year 1 investment for structural margin expansion and reallocating 75% of SMB sales capacity to higher-value enterprise deals.

SMB P&L Transformation: Year 0 (Current) → Year 2 (Optimized)

Line Item | Year 0 (Current) | Year 1 (Transition) | Year 2 (Optimized) | Key Driver |

|---|---|---|---|---|

REVENUE | ||||

SMB ARR | $50M | $50M | $60M | Existing + new self-serve + usage expansion |

OPEX COSTS | ||||

Sales Reps (Team & Comp) | -$14M | -$3.7M | -$4M | Step 2: Hand-raiser system + Sales Assist (200 reps →55→50) |

Sales Managers | -$4M | -$1.92M | -$1.28M | Flatter org (25→12→8 managers) |

Sales Tooling | -$2M | -$1.5M | -$0.8M | Step 2: Add hand-raiser tools (Groove/Zendesk) |

RevOps & Data | -$1.2M | -$1.2M | -$0.5M | Automation + optimization |

Self-Serve Ops (Product/Eng) | $0 | -$2M | -$1M | Build hand-raiser + PLG, then maintain |

Customer Support | -$3.5M | -$3.2M | -$1.2M | Self-serve reduces tickets 65% by Y2 |

Implementation / Onboarding | -$1.5M | -$1M | -$0.2M | |

Total OPEX | -$26.2M | -$14.52M | -$9M | 66% cost reduction |

GROSS PROFIT | $13.8M | $35.48M | $51M | 270% improvement |

Margin % | 27.6% | 70.9% | 85% | Operational leverage |

Over 18-24 months, the same $50M+ revenue base operates at 85% margin instead of 27%, unlocking $37M+ ($51M - $13M) in profit improvement.

For more on building product-led growth into your organization's DNA, see my reflection on The Real Journey to Product-Led Growth, where I share lessons learned from operationalizing this transformation at scale

Conclusion: How do you execute this Product-Led and sales efficiency growth without breaking the business?

Managing a cruise ship is hard. But steering it toward profitable waters is the job.

For a mature, $300M SaaS company, the next phase of growth won't come from "hiring more salespeople." It will come from better operations. Here's what I will execute to pull it off:

Trading Year 1 to run Sales-led and Product-led

I will execute the 18 months of two simultaneous GTMs. Year 1 is operational chaos. We are supporting the legacy sales machine while building the new product-led engine. The board questions the PLG investment. "We are trading Year 1 margin investment for structural profit expansion. Revenue is intentionally flat while we rebuild the cost structure. By Month 18, we are accelerating growth on an 85% margin base."

Top-down strategic mandate and new incentives

I will work with the CRO to move the best SMB sales talent to Mid-Market and Enterprise. The “old guard” sales reps will resist hand-raisers. Our engineers will push back on product simplification. I understand that friction, I have navigated it before. We reiterate the new company mandate as part of our alignment strategy. Otherwise, we are fighting culture wars while trying to execute.

Build a Self-Serve engine that scales

I will partner with the Product team to design the hand-raiser system, simplify the product, and establish the right KPIs. 80% of new SMB acquisition is self-serve. 20% routes through Sales Assist for high-intent hand-raisers. This will scale 85% margins and NRR >120%. Then we align product, sales ops, and go-to-market accordingly. But if we keep the old sales team and avoid simplifying the product, we will be stuck at 27% margin.

By treating SMB as a product problem (not a sales problem), this 30-year-old company can unlock modern SaaS growth with self-serve, PLG, and usage-based pricing.

I have built this transformation. I understand what breaks it, and how to navigate the friction. If you want to discuss how to implement this, let's talk.

I write weekly about my learning on launching and leading PLG. Feel free to subscribe.

I am Gary Yau Chan. 3x Head of Growth. 2x Founder. Product Led Growth specialist. 26x hackathon winner. I write about #PLG and #BuildInPublic. Please follow me on LinkedIn, or read about what you can hire me for on my Notion page.

![PLG vs SLG: How to Choose? [Framework]](https://media.beehiiv.com/cdn-cgi/image/format=auto,fit=scale-down,onerror=redirect/uploads/asset/file/add0e243-a663-4f5b-81a5-0554cd609c17/image.png)

![LTV CAC Ratio Payback Formula [Free Download Template]](https://media.beehiiv.com/cdn-cgi/image/format=auto,fit=scale-down,onerror=redirect/uploads/asset/file/44a1862d-a0e4-478c-b87f-038cdd79daef/Screenshot_2024-09-18_at_3.44.16_PM.png)