Storyblok is a headless CMS product. As opposed to using WordPress, companies need a more sophisticated platform to host their website and content. This pricing teardown is to understand where the PLG signals are, how to activate customers to upgrade, and drive revenue.

Table of Contents

How does pricing strategy actually drive Product-Led Growth?

For PLG companies, the pricing page is a business model diagram (shows how the business believes it will make money) and the operational routing layer that decides who gets self-serve purchase and who gets human-assisted.

The goal here is not to say Storyblok’s pricing is right or wrong, but to understand the PLG and PLS business model logic behind it and what a Head of PLG can do with it.

In a Product-Led Growth model, the pricing page replaces the first 15 minutes of a sales qualification call. Transparency creates predictability. PLG buyers (often developers or product managers) are risk-averse regarding "lock-in." If they can’t see what success costs, they won't even start. By listing the product parameters upfront, Storyblok answers the customer's silent question: "If this project succeeds and we scale to 1 million users, what would it cost me?"

Transparent pricing aligns with the core PLG promise: Try before you buy, and know what you’ll pay before you scale.

Sometimes the pricing plan "fences" between each tier can feel strict or limiting. As one Storyblok customer noted on Reddit: "Just built a project on it. It’s not bad, but hiding some really basic functionality … behind insanely expensive tiers, is wild to me." Source: Reddit.

Granted, you can never satisfy every customer with your pricing, it reveals how customer shop and compare apple-to-apple. Its a business decision, whether to go after cost-sensitive customers. Thats how pricing can position SaaS businesses and what customer-type it is serving.

What are the Storyblok PLG signals? What is the “Squeeze”?

Patrick Campbell’s (Price Intelligently/Paddle) core idea is that great pricing uses a value metric that scales with customer outcomes, and then wraps tiers around that metric to guide expansion instead of surprising people with random cliffs.

"If you don't have a value metric, you're not charging for value. You're charging for access." — Patrick Campbell

Storyblok’s value metrics are a hybrid of multiple limits that create a "squeeze" from free → paid → sales-assisted:

Collaboration (Seats, Roles): Monetizes organizational complexity.

Consumption (Traffic, API calls): Monetizes raw technical scale.

Maturity (Locales, Governance, Security): Monetizes business reach and risk.

By mixing these, Storyblok captures most customer profiles, whether it’s a small team with huge traffic pays through the "consumption squeeze”, or a large corporate team with low traffic pays via the “workflow and governance squeeze.”

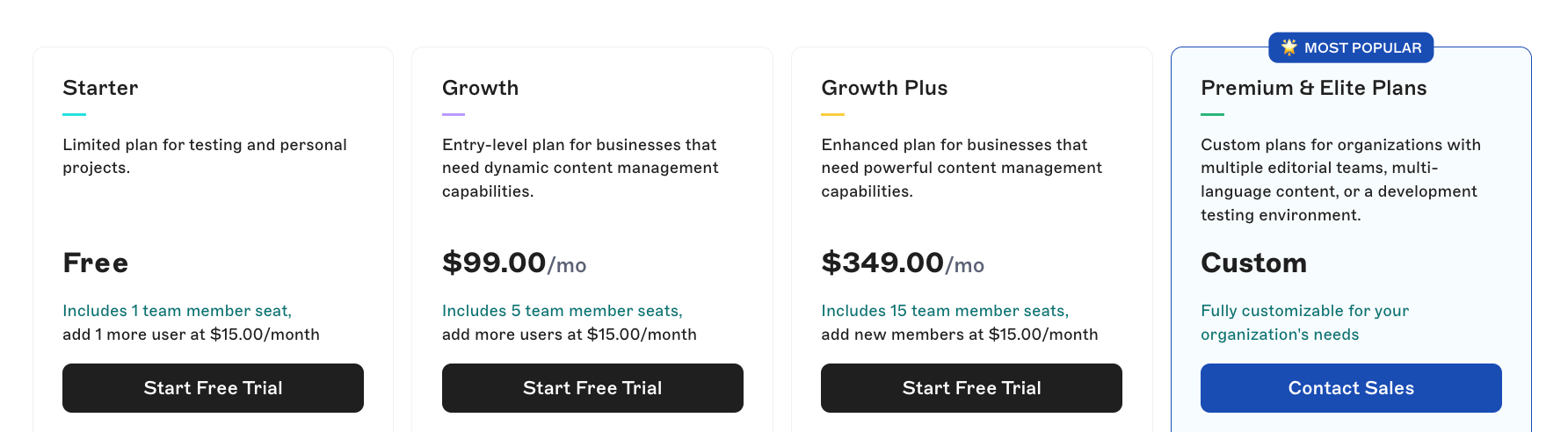

What is each Storyblok plan used for?

Let’s first understand what tier customers start at, the purpose of each tier, and why customers upgrade.

Why does Storyblok’s Starter (Free) plan start with 1 seat?

A front-end dev or small tiger team proves out “Next.js + Storyblok” and shows it to one collaborator. Get the technical champion validate the technical stack.

Starter is optimized for activation. It has 1 included user (hard cap at 2). Tight limits on traffic, API calls, and locales. No ability to buy more traffic or locales.

Inviting the next stakeholder, the Marketing team, is the trigger to move up the next pricing tier.

This headless CMS industry have to win over two stakeholders: developers and marketers. That can be very tricky and probably requires a lot of hand-holding.

Why jump into the Paid Growth ($99/mo) plan?

The Developer invites a Marketer to the prototype. The Marketer falls in love with the Visual Editor. This triggers the "Aha!" moment. Both customers’ stakeholders approve.

Growth tier is the first “real” plan: 5 included seats, 2 locales included. Customers can buy overages (extra traffic, locales).

Users, Traffics, and Locales are levers. Easy add-ons to purchase.

Don’t have to jump to Growth Plus (yet).

Storyblok allows you to “patch” the upgrade with add-ons for a while. But that is the squeeze… Eventually, the cost and complexity of add-ons make consideration to jump to the next tier, Growth Plus ($349/mo). But most customers would try to sit on this Growth tier ($99/mo) until they cannot.

Why upgrade to the Growth Plus ($349/mo) plan?

Assets and Stories are cliffs. No add-ons available. Must jump to Growth Plus.

The real cliffs between Growth and Growth Plus aren’t seats, traffic, or locales. These levers all have add-ons. The hard walls are Stories and Assets, which have fixed maximums on Growth and expand significantly on Growth Plus.

These limits caught customers by surprise. Reddit user described the asset limit as a trap door: "It starts at $99 and jumps straight to $349 if you surpass the asset threshold... basically one image file over the threshold and your price goes up 250 euros." This case has then been resolve by Storyblok reaching out to this legacy customer. Source: Reddit.

Customers feel these cliffs. The upgrade trigger here is often forced by limitation rather than value-driven.

The Growth Plus tier's biggest levers are 15 seats, 10 locales, and an increase in assets and stories. The narrative for this tier is more like a “Scale-up” plan, when customers outgrow their limits on assets and stories.

The Growth Plus plan ($349/mo) is also a "waiting room" for companies that are too big for $99/mo but not yet worried about enterprise-level governance.

Because ultimately, if customers can buy at this $349/mo plan, how can we create upsell more to $400/mo or $500/mo. And can we wrap this in an annual plan with discount, ex: $5000/yr after 20% discount (which is a +$812/yr upfront).

So we can re-invest back into our growth loop flywheel.

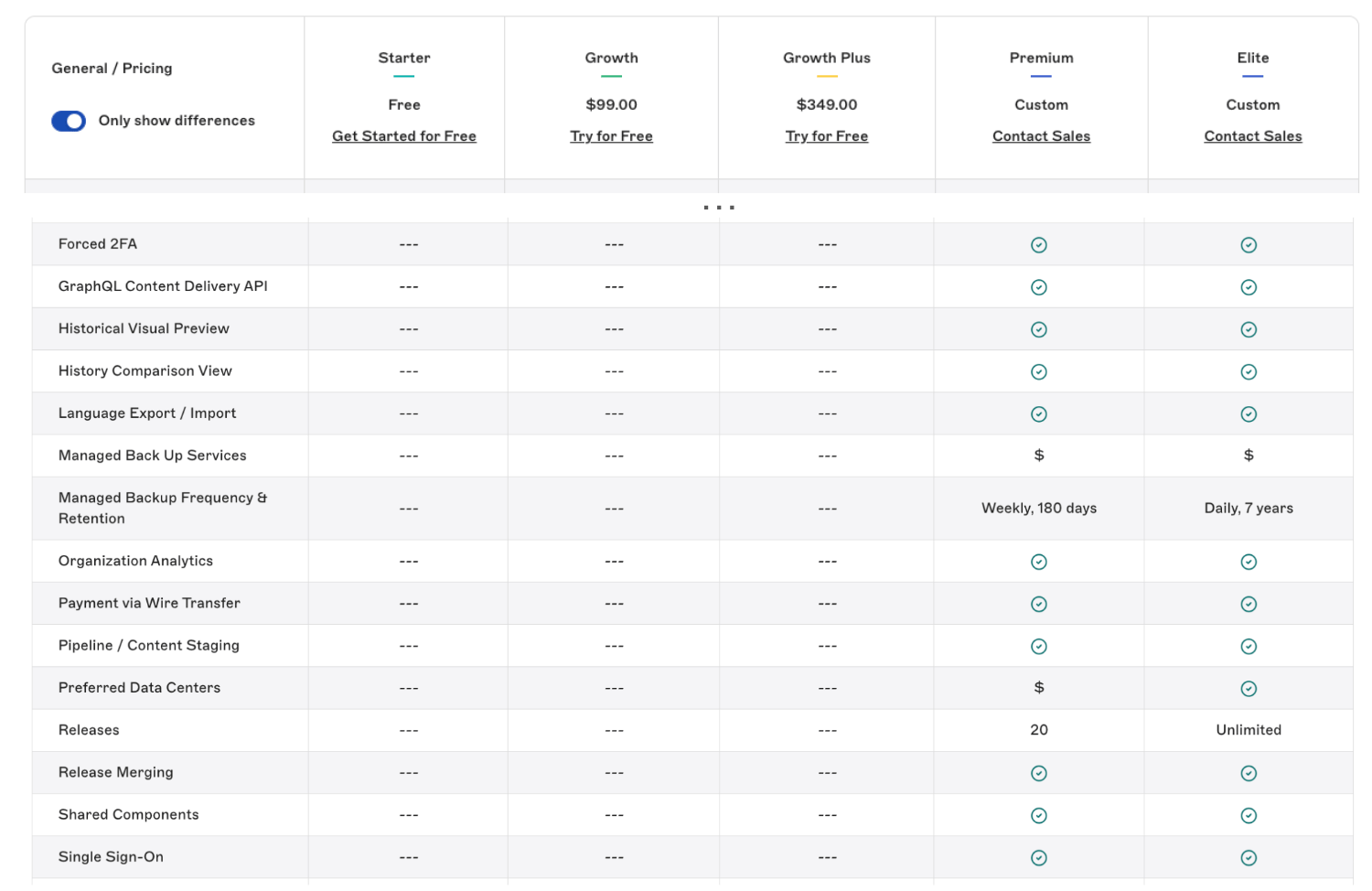

When to call sales to upgrade to Premium and Elite tiers (Custom Pricing)?

Here, the value metric changes entirely. Customers are not paying for GBs or seats. Customers are paying for risk reduction and control.

SSO / identity integrations Custom roles and workflows, release management and pipelines, managed backup frequency & retention, higher uptime SLAs, support, and security options

All governance and risk control under Enterprise (Premium / Elite)

This aligns with Ulrik Lehrskov-Schmidt’s concept of "Fencing." He argues that Enterprise tiers should not just be "more of the same," but should be fenced around a specific Job to be Done.

First, separate your market into fences... For each fence, you decide what is actually for sale... If you want your customers to upgrade from 'advanced' to 'enterprise', you better have designed 'enterprise' to appear to be the perfect solution to whatever job your 'advanced' customer is trying to get done.

In this case, the "Job to be Done" shifts from "Build a Website" (Growth) to "Protect the Organization" (Enterprise).

What are the growth levers and PQLs for PLG hands off to PLS?

PQL (Product Qualified Lead) work is about finding moments where product behavior signals readiness for a bigger conversation. We need to identify specific actions that correlate with an increased Willingness to Pay.

Below are the key transitions in Storyblok’s funnel:

Growth ($99/mo) → Growth Plus ($349/mo)

Capture high-volume asset users and scaling teams

Type | What happens | Why it matters |

|---|---|---|

Hard Gate | Hitting the 2,500 Asset Limit. | Unlike locales, assets have a hard cap. Teams hitting this are forced to upgrade or delete content. This is the primary "Cliff." |

PQL Signal | High Asset Velocity (uploading >50 images/week); Using 6+ Seats; Using 3+ Locales. | These users are piecing together a "Frankenstein" plan with add-ons. They are ripe for a bundle pitch. |

PLS Action | "Bundle & Safety" Pitch: "You're approaching the asset limit and paying extra for seats/locales. Growth Plus gives you 4x the assets and includes everything you're buying separately." | Position the upgrade as Cost Efficiency + Limit Avoidance, not just "more features." |

Get customers to go from scaling to governance.

Type | What happens | Why it matters |

|---|---|---|

Hard Gate | Attempting to configure SSO or Custom Roles. | These features are strictly gated to Premium/Enterprise. If they click it, they have budget. |

PQL Signal | Enterprise Integrations (SAP, Salesforce, CommerceTools); Backup/Restore Searches; Security Questions. | These signals indicate "Platform Criticality." The CMS is now mission-critical infrastructure. |

PLS Action | "Risk & Control" Pitch: "You're running mission-critical workflows. Let's move you to a plan with SLA guarantees, SSO enforcement, and immutable backups." | Shift the conversation from "Price" to "Insurance." |

Growth ($99/mo) → Premium/Elite (Custom)

Some customers will never care about $349 vs $99. They care about whether the platform can pass an audit or support a complex org structure.

PQL patterns include high-value domains (Fortune 500) or questions about SSO/SLA/Hosting Location. Route immediately to Sales. Do not nurture.

What to do if you are leading PLG at Storyblok?

Make Growth Plus a destination, not a penalty

Right now, Growth Plus ($349/mo) has an identity crisis. It doesn’t have the qualitative features of Enterprise (SSO, Custom Roles) but costs 3.5x more than Growth ($99). It is just a "Bigger Bucket" of limits.

Most customers would want to start at Growth ($99/mo) with add-ons. Until the bill of having add-ons surpasses Growth Plus ($349/mo), there is no reason to begin at Growth Plus. “The place you land when add-ons get too expensive.”

If just starting, would just go for Growth first, and test it out.

Today, some users perceive Growth Plus as something they are “pushed into” rather than choose, especially when limits (like assets and stories) force an upgrade from $99/mo to $349/mo.

“Begrudgingly upgrade" when customers pay because they are hostage to the data, not because they see value.

I pay for iCloud storage, not because more features, but without it, my Notes and Photos are useless. I am not happy to upgrade, I have to upgrade. Back of my mind, I am thinking how to switch out to Google Photos and Notion.

That’s a classic pattern Patrick Campbell warns against: tiers perceived as pure monetization, not new value.

Reposition Growth Plus as the “Workflow Tier.” Move Content Staging, and Approval Workflows from the Custom Enterprise plan down to Growth Plus.

By wrapping Workflow Features (Staging/Approvals) into the Growth Plus tier, we transform it from a "Storage Tax” (limit on Assets and Stories) into a "Workflow Standard." Teams will start here or upgrade to proactively to protect their brand, not just to store more image JPEGs.

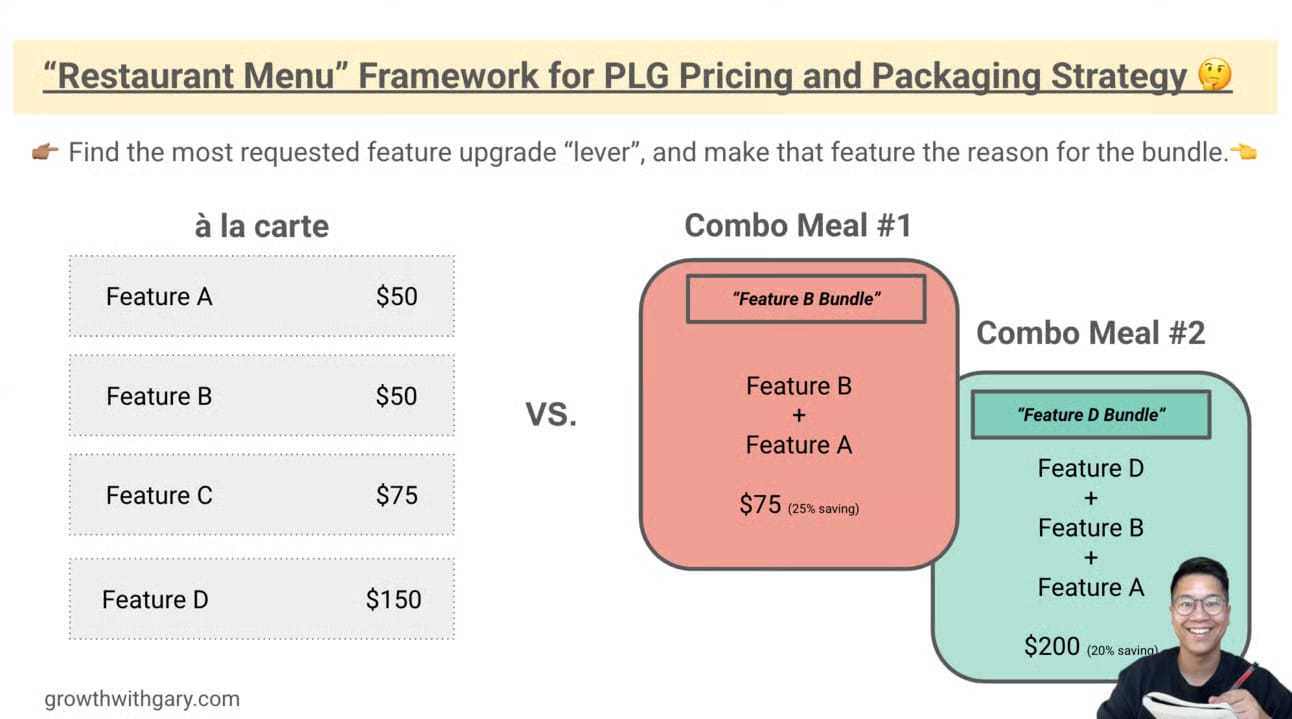

Read more about the Secret Pricing & Packaging Framework: "Restaurant menu" for PLG:

Instrumenting "Maturity" PQLs

Premium/Elite is about security and risk management. Incorporate a PQL score for accounts based on this JTBD:

Governance Score: (Attempts to create Custom Roles) + (Number of Admins).

Risk Score: (Backup/Restore queries) + (SSO Config attempts).

Integration Score: (Connecting Commerce/PIM tools) + (Webhook usage).

When an account has a high "Governance Score" but is still on the $99 plan, that is the hottest lead. They are an Enterprise company hiding in a cheap plan.

Conduct discovery and outreach using Sales

Not everything can be captured using product signals. Use the Sales team to validate the PQL hypothesis.

Outreach and ask, "I see you're managing 3 different brands on one space. Usually, teams like yours move to a 'Risk-Managed' setup to prevent cross-brand errors. Open to a chat?"

We are selling reassurance in security and governance, beyond hitting limits like gigabytes.

Compare to competitors

This article is about a pricing teardown to understand the PLG motion of a company. How it compares to headless CMS competitors like Sanity.

Sanity acts like a "Developer's Database." You pay for volume (Bandwidth, Requests). Locales are free and unlimited because they are treated as simple data fields, and you build the UI yourself. The business model is more like an AWS-style consumption bill as you scale.

See my article on Usage-Based Pricing in PLG and the Land & Expand PLG model.

Storyblok acts like a "Marketer's Page Builder." You pay for Complexity (Seats, Locales). Pay for Locales because Storyblok provides a pre-built Visual Interface that saves marketers time. The trade-off is hitting "Plan Cliffs" when you grow your team or market reach.

Storyblok charges a premium because they solve the UI problem for marketers. Sanity is cheaper to start because they do not offer a UI.

How to propose changing pricing and packaging?

Is the cliff helping us generate more revenue, or is it potentially creating unhappy customers and, more potential churn? Is it about ramping customers up with add-on’s, or is it about gating to hit the next tier?

When customers on the $99/mo plan hit their "Asset Limit" cap, they face a steep $349/mo (+$250/mo) jump to the next tier. If there is a conversion of 10% upgrade rate while keeping churn below 5%, then the math is positive.

The Math:

Current Revenue: (100 customers 10% upgrade * $250 delta) = $2,500 new MRR.

Churn Loss: (100 customers 5% churn * $99) = -$495 MRR.

Net Impact: +$2,005 MRR.

With the proposal to have an Asset Add-on, and assume 40% of customers would purchase at $20/mo, with 1% churn.

The Add-on Math:

Add-on Revenue: (100 customers, 40% buy add-on * $20) = $800 new MRR.

Churn Loss: (100 customers 1% churn $99) = -$99 MRR.

Net Impact: +$701 MRR.

In this hypothetical, the Hard Cliff wins ($2,005 vs $701). This explains why Storyblok keeps the asset limit as a hard wall. It forces enough upgrades to outweigh the churn. You would only switch to Add-ons if the "Cliff Churn" was massive (e.g., >20%) or the "Upgrade Rate" was tiny (<2%).

With Patrick Campbell’s framework regarding "Ramps" vs. "Fences”, the core value metrics (like Traffic and Seats) should act as ramps that scale smoothly, while binary features (like SSO) act as fences.

The danger zone for Storyblok lies in "Lopsided Usage."

If data shows that customers upgrade to the $349 tier solely for Assets, while leaving the extra seats and locales unused, you are not capturing value; you are generating resentment. These customers feel they are paying for a banquet just to get one specific dish. This "grudge spend" is a leading indicator of long-term churn, suggesting that Asset Limits should be softened with an à la carte add-on rather than acting as a hard wall.

What does Storyblok’s pricing tell us about improving its PLG strategy?

Storyblok’s pricing model is a study in balancing two distinct forces:

Consumption Limits (Traffic, Seats, Assets) act as the Safety Rails that protect margins and force upgrades at scale.

Maturity Features (Governance, Security, Workflow) act as the Magnet for high-value Enterprise contracts.

The job of a Head of PLG is not to remove the friction, but to optimize when it appears. Consumption limits should remain invisible to early-stage builders but become obvious, rational steps for scaling teams. Meanwhile, Maturity Signals—like requests for SSO, custom roles, or backup retention—must be instantly caught and routed to a human. These signals indicate a customer who is ready to buy Risk Reduction, not just more features. By mastering this handoff between product-led limits and sales-led value, Storyblok can turn its "Mid-Market Sandwich" into a highly efficient engine for enterprise expansion.

I write weekly about my learning on launching and leading PLG. Feel free to subscribe.

I am Gary Yau Chan. 3x Head of Growth. 2x Founder. Product Led Growth specialist. 26x hackathon winner. I write about #PLG and #BuildInPublic. Please follow me on LinkedIn, or read about what you can hire me for on my Notion page.

![PLG vs SLG: How to Choose? [Framework]](https://media.beehiiv.com/cdn-cgi/image/format=auto,fit=scale-down,onerror=redirect/uploads/asset/file/add0e243-a663-4f5b-81a5-0554cd609c17/image.png)

![LTV CAC Ratio Payback Formula [Free Download Template]](https://media.beehiiv.com/cdn-cgi/image/format=auto,fit=scale-down,onerror=redirect/uploads/asset/file/44a1862d-a0e4-478c-b87f-038cdd79daef/Screenshot_2024-09-18_at_3.44.16_PM.png)